The original statement, made by James Carville in 1992 was “The economy, stupid”. The phrase was directed at workers in Bill Clinton’s camp and intended as one of the messages for them to focus on in the campaign against incumbent George H. W. Bush. It has since been taken out of context and misquoted as “It’s the economy, stupid”. But there are many senses in which this ‘bromide’ can still be used to focus our attention on what is important, even if several academics now point to the fact that inequality in the world economy today would lead us to rethink its veracity.

Assuming that the original statement still holds some water, we see that our own economy has been under stress of the coronavirus pandemic for that last two years. Our government has been trying its best to keep the economy on an even keel, even if some sectors seem to have more or less gone bust. For one, inflation has been largely controlled because of stifled demand and foreign currency exchange rates have surprisingly improved by as much as 6% in some instances. Food prices have fallen, even if not for the right reasons and Bank of Uganda (BOU) has continually lowered the central bank rate. In that respect then (keeping all other factors constant, as economists are wont to say) there have been some positive outcomes.

But that may be as far as it goes – skin deep. The more serious damage will take time to show. Last week, BOU again announced new/additional credit relief measures (CRM) for hotels and schools. These new measures are really a continuation of the existing directives, only that these are specifically applicable to hotels and schools. Commercial Banks were advised to restructure loans to hotels and schools and also freeze all interest computations for another year, effective October 2021. There are a number of hurdles we face here.

First is the fact that banks have been booking and capitalizing interest on loans under the CRM. They expect that when the economy ‘opens’ up the business owners will switch on a light and start servicing these loans. That is akin to being ostrich-like – kicking the can down the road. If interest charges are still due, then the business owners who have not had any meaningful activity for the last two years will still be carrying that can on behalf of those banks. The second hurdle is the assumption that hotels and schools exist in a vacuum. Again the thinking is that when receive an edict to the effect that ‘the economy is n ow fully open’ – meaning that kids can go to school, drunkards can freely have their tipple without locking themselves in bars and that there is in no more curfew, life will ‘normalise’.

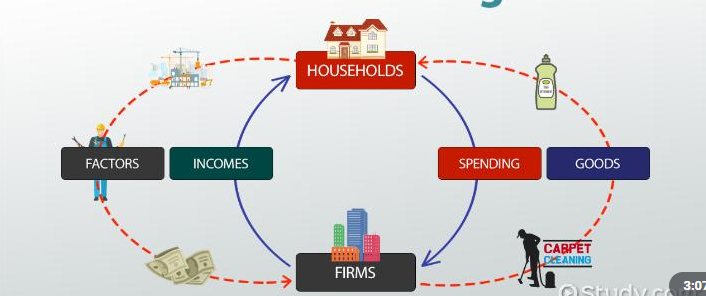

I am afraid that may not be the case despite the resilience shown by some proprietors. Schools are part of a system of circular flow of incomes. By the time the schools open, some teachers will have left the profession, school suppliers would equally have become bankrupted, and several other parts of the system may have been badly affected. In addition, the debt burden on the school owners would have grown. The hotels are no different. Simply put, the economy works by allowing for money to move form hand to hand in the society. Money flows from producers to workers as wages and flows back to producers as payment for products. A working economy is an endless circular flow of money.

It is in this context that BOU’s credit relief measures become unrealistic. They, like other government departments are taking a silo-view of the problem – providing relief here, directives there, and tokens elsewhere. What we need is a wholistic multi sectoral solution for what we are going to face as an economy, come this so called ‘opening up’. If some parts do not work, the whole does not work efficiently. It is the whole of the economy, stupid!

Samuel Sejjaaka is Country Team Leader at MAT Abacus Business School. Twitter @samuelsejjaaka