This tale is not new. I first heard it about six years ago in a Directors training workshop in South Africa. There was this plump and jolly (sorry I forget his name but he would love it if he had me call him this) ‘effin’ facilitator who you just had to love. He just didn’t teach or facilitate. He told stories and he did it so well I still remember many of them after all those years! Mangement lessons he called them.

‘Long time ago, in the body kingdom’, he cheekily narrated, ‘all the body parts lived in harmony. They woke up each morning to play and make merry. They had lots of fun until they grew up. So one day, responsibility came home and they had to chose a leader. They convened a meeting and agreed it was time to choose a leader. All the members of the body said they should be the leader.’

The heart shouted ‘I should be your leader! I pump the blood that keeps you alive!’

The brain exclaimed ‘No! I should! I do the thinking that keeps you out of trouble!’

The hands condescendingly looked at all the other body parts and said ‘You guys are all mistaken! I am the most important because I feed you. I must be the leader!’

‘On and on it went, round and round, until they had this small squeaky voice say, ‘But I am the most important part of the body. I should be your leader!” All the other body parts laughed with derision and the squeaky guy got so annoyed. He said, ‘Ok, I am going on strike if you don’t believe I am the most important and should be the leader.’

‘And so the squeaky guy went on strike. Soon the whole body turned blue black as the body kingdom became blotted with poison. They convened an urgent meeting and asked the squeaky guy who was all puffed up and swollen from not working to relent. He refused and demanded he be made the leader. In the interests of surviving the oncoming poisonous attack, the body parts all agreed and elected the Asshole leader of the body kingdom. After his elevation, order was restored in the body kingdom as Mr. Asshole stopped poisoning the kingdom and went to work!’

The management moral of the story, our affable ‘effin’ facilitator told us was that beware who becomes your leader. Through a poor selection processes, any ‘asshole’ can become your leader with disastrous consequences. In politics it may not be attritional but not debilitating if it is not at the top echelons (as is usually the case), but for corporations this can spell disaster! But if it is at the top, whole civilizations can be wiped out if you choose Mr ‘Asshole’ as leader of the nation.

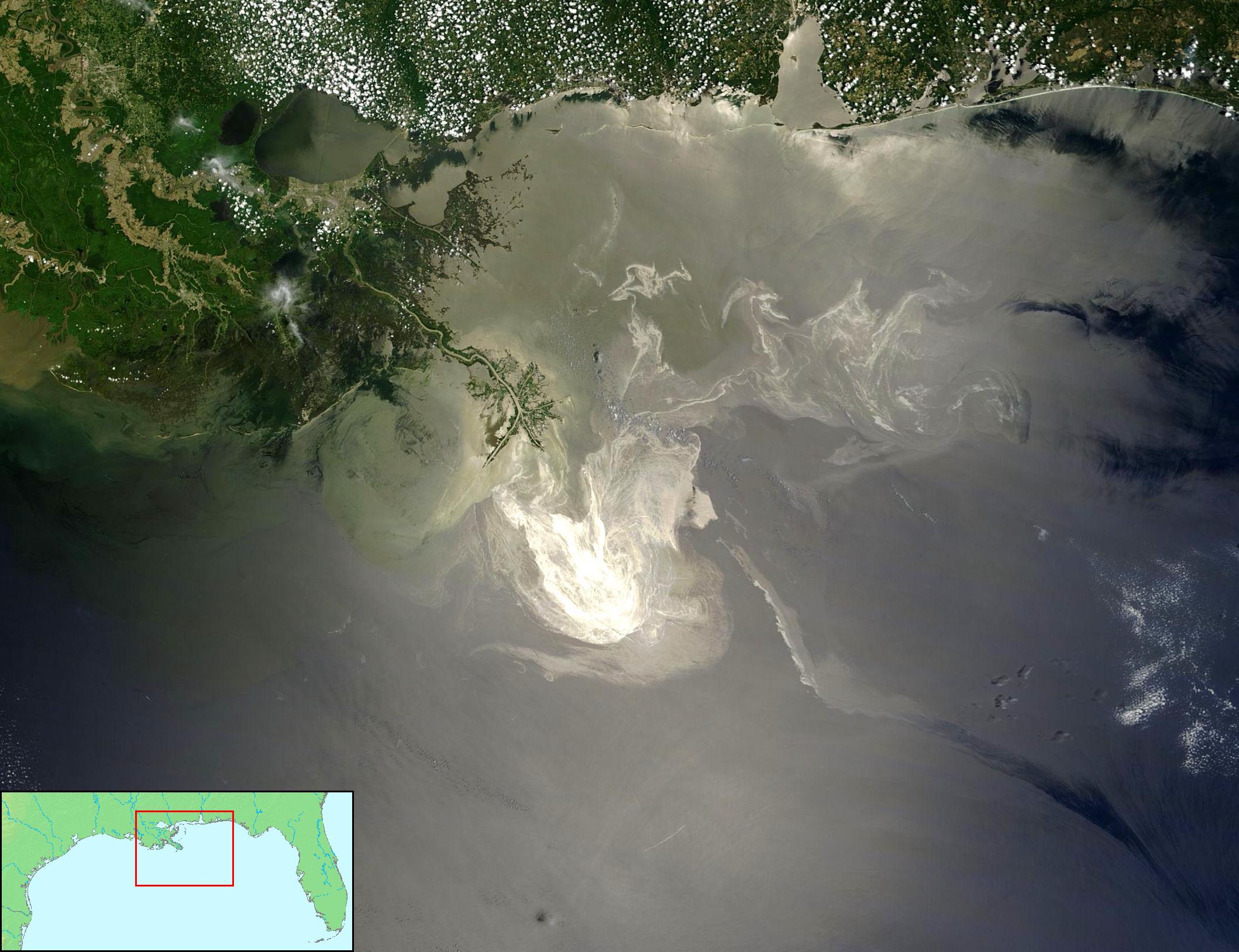

We then went through a catalogue of corporations where ‘assholes’ had taken charge. From Enron, to Parmalat, to Santadar to BP, things had gone wrong because the wrong team member had taken charge at the wrong time by virtue of his/her importance in the organization rather than their ability to transform the team. The Deepwater Horizon oil spill in the Gulf of Mexico is very instructive. While the disaster was unfolding, the man with whom the buck stopped decided he needed a holiday and off he went to play golf! The rest is history as they say

So mind the gap, any ‘asshole’ could wind up on top of your organization. If you doubt me here is a sample of corporate disasters over the centuries from good old Wiki!

| Name | HQ | Date | Business | Causes |

| Medici Bank | 1494 | Banking | Owned by the Medici family, it ran up large debts due to the family’s profligate spending, extravagant lifestyle, and failure to control the managers, their bank went insolvent. | |

| Mississippi Company | Sep 1720 | Colonialism | Scottish economist John Law convinced the French government to support a monopoly trade venture in Louisiana. He marketed shares based on great wealth, which was highly exaggerated. A speculative bubble grew and then collapsed, and Law was expelled. | |

| South Sea Company | Sep 1720 | Slavery and colonialism | After the War of Spanish Succession, the UK signed the Treaty of Utrecht 1713 with Spain, ostensibly allowing it to trade in the seas near South America. In fact, barely any trade took place as Spain renounced the Treaty, however this was concealed on the UK stock market. A speculative bubble saw the share price reach over £1000 in August 1720, but then crash in September. A Parliamentary inquiry revealed fraud among members of the government, including the Tory Chancellor of the Exchequer John Aislabie, who was sent to prison. | |

| Overend, Gurney & Co | June 1866 | Banking | After Samuel Gurney‘s retirement, the bank invested heavily in railway stocks. It went public in 1865, but was badly affected by a general fall in stock prices. The Bank of England refused to advance money, and it collapsed. The directors were sued, but exonerated from fraud. | |

| Friedrich Krupp AG | 1873 | Steel, metals | Krupp’s business over-expanded, and had to take a 30m Mark loan from the Preußische Bank, the Bank of Prussia. | |

| Danatbank | 13 July 1931 | Banking | At the start of the Great Depression, after rumours about the solvency of the Norddeutsche Wollkämmerei & Kammgarnspinnerei, there was a bank run, and Danatbank was forced into insolvency. | |

| Allied Crude Vegetable Oil Refining Corp | 16 Nov 1963 | Commodities | Commodities trade Tino De Angelis defrauded clients, including the Bank of America into thinking he was trading vegetable oil. He got loans and made money using the oil as collateral. He showed inspectors tankers of water, with a bit of oil on the surface. When the fraud was exposed, the business collapsed. | |

| Herstatt Bank | 26 June 1974 | Banking | Settlement risk. Counterparty banks did not receive their USD payments, where Herstatt had received DEM earlier, prior to government forced liquidation. | |

| Texaco | 13 April 1987 | Oil | After a legal battle with Pennzoil, whereby it was found to owe a debt of $10.5 bn, Texaco went into bankruptcy. It was later resurrected and taken over by Chevron. | |

| Qintex | 1989 | Real Estate | Qintex CEO Christopher Skase was found to have improperly used his position to obtain management fees prior to the $1.5 billion collapse of Qintex including $700m unpaid debts. Skase absconded to the Spanish resort island of Majorca. Spain refused extradition for 10 years during which time Skase became a citizen of Dominica. | |

| Polly Peck | 30 Oct 1990 | Electronics, food, textiles | After a raid by the UK Serious Fraud Office in September 1990, the share price collapsed. The CEO Asil Nadir was convicted of stealing the company’s money. | |

| Bank of Credit and Commerce International | 5 July 1991 | Banking | Breach of US law, by owning another bank. Fraud, money laundering and larceny. | |

| Nordbanken | 1991 | Banking | Following market deregulation, there was a housing price bubble, and it burst. As part of a general rescue as the Swedish banking crisis unfolded, Nordbanken was nationalised for 64 billion kronor. It was later merged with Götabanken, which itself had to write off 37.3% of its creditors, and is now known as Nordea. | |

| Carrian Group | 1993 | Real estate | Accounting fraud. An auditor was murdered, an adviser committed suicide. The largest collapse in Hong Kong history. | |

| Barings Bank | 26 Feb 1995 | Banking | An employee in Singapore, Nick Leeson, traded futures, signed off on his own accounts and became increasingly indebted. The London directors were subsequently disqualified, as being unfit to run a company in Re Barings plc (No 5). | |

| Long-Term Capital Management | 23 Sep 1998 | Hedge fund | After purporting to have discovered a scientific method of calculating derivative prices, LTCM lost $4.6bn in the first few months of 1998, and required state assistance to remain afloat. | |

| Equitable Life Assurance Society | 8 Dec 2000 | Insurance | The insurance company’s directors unlawfully used money from people holding guaranteed annuity rate policies to subsidise people with current annuity rate policies. After a House of Lords judgment in Equitable Life Assurance Society v Hyman, the Society closed. Though never technically insolvent, the UK government set up a compensation scheme for policyholders under the Equitable Life (Payments) Act 2010. | |

| HIH Insurance | 15 March 2001 | Insurance | In early 2000, after increase in size of the business, it was determined that the insurance company’s solvency was marginal, and a small asset price change could see the insurance company become insolvent. It did. Director Rodney Adler, CEO Ray Williams and others were sentenced to prison for fraudulent activity. | |

| Pacific Gas and Electric Company | 6 April 2001 | Energy | After a change in regulation in California, the company determined it was unable to continue delivering power, and despite the California Public Utility Commission‘s efforts, it went into bankruptcy, leaving homes without energy. It emerged again in 2004. | |

| One.Tel | 29 May 2001 | Telecomms | After becoming one of the largest Australian public companies, losses of $290m were reported, the share price crashed, and it entered administration. In ASIC v Rich[1] the directors were found not to have been guilty of negligence. | |

| WorldCom | 21 July 2001 | Telecomms | After falling share prices, and a failed share buy back scheme, it was found that the directors had used fraudulent accounting methods to push up the stock price. Rebranded MCI Inc, it emerged from bankruptcy in 2004 and the assets were bought by Verizon. | |

| Enron | 28 Nov 2001 | Energy | Directors and executives fraudulently concealed large losses in Enron’s projects. A number were sentenced to prison.[2][3] | |

| Chiquita Brands Int | 28 Nov 2001 | Food | Accumulated debts, after a series of accusations relating to breaches of labour and environmental standards. It entered a pre-packaged insolvency, and emerged with similar management in 2002.[4] | |

| Kmart | 22 Jan 2002 | Retail | After difficult competition, the store was put into Chapter 11 bankruptcy proceedings, but soon re-emerged. | |

| Adelphia Communications | 13 Feb 2002 | Cable television | Internal corruption. The Directors were sentenced to prison.[3][5] | |

| Arthur Andersen | 15 June 2002 | Accounting | A US court convicted Andersen of obstruction of justice by shredding documents relating to Enron scandal. | |

| Bre-X | 2002 | Mining | After widespread reports that Bre-X had found a gold mine in Indonesia, the stories were found to be fraudulent. | |

| Parmalat | 24 Dec 2003 | Food | The company’s finance directors concealed large debts. | |

| MG Rover Group | 15 April 2005 | Automobiles | After diminishing demand, and getting a £6.5m loan from the UK government in April 2005, the company went into administration. After the loss of 30,000 jobs, Nanjing Automobile Group bought the company’s assets. | |

| Bayou Hedge Fund Group | 29 Sep 2005 | Hedge fund | Samuel Israel III defrauded his investors into thinking there were higher returns, and orchestrated fake audits. The Commodity Futures Trading Commission filed a court complaint and the business was shut down after the directors were caught attempting to send $100m into overseas bank accounts. | |

| Refco | 17 Oct 2005 | Brokering | After becoming a public company in August 2005, it was revealed that Phillip R. Bennett, the company CEO and chair, had concealed $430m of bad debts. Its underwriters were Credit Suisse First Boston, Goldman Sachs, and Bank of America Corp. The company entered Chapter 11 and Bennett was sentenced to 16 years prison. | |

| Bear Stearns | 14 Mar 2008 | Banking | Bearn Stearns invested in the sub-prime mortgage market from 2003 after the US government had begun to deregulate consumer protection and derivative trading. The business collapsed as more people began to be unable to meet mortgage obligations. After a stock price high of $172 a share, it was bought by JP Morgan for $2 a share on 16 March 2008, with a $29bn loan facility guaranteed by the US Federal Reserve. | |

| Northern Rock | 22 Feb 2008 | Banking | Northern Rock had invested in the international markets for sub-prime mortgage debt, and as more and more people defaulted on their home loans in the US, the Rock’s business collapsed. It triggered the first bank run in the UK since Overend, Gurney & Co in 1866, when it asked the UK government for assistance. It was nationalised, and then sold to Virgin Money in 2012. | |

| Lehman Brothers | 15 Sep 2008 | Banking | Lehman Brothers’ financial strategy in from 2003 was to invest heavily in mortgage debt, in markets which were being deregulated from consumer protection by the US government. Losses mounted, and Lehman Brothers was forced to file for Chapter 11 bankruptcy after the US government refused to extend a loan. The collapse triggered a global financial market meltdown. Barclays, Nomura and Bain Capital purchased the assets which were not indebted. | |

| AIG[3] | 16 Sep 2008 | Insurance | Out of $441 billion worth of securities originally rated AAA, as the US sub-prime mortgage crisis unfolded, AIG found it held $57.8 billion of these products. It was forced to take a 24 month credit facility from the US Federal Reserve Board. | |

| Washington Mutual | 26 Sep 2008 | Banking | Following the sub-prime mortgage crisis, there was a bank run on WaMu, and pressure from the FDIC forced closure. | |

| Royal Bank of Scotland Group | 13 Oct 2008 | Banking | Following the takeover of ABN-Amro, and the collapse of Lehman Bros, RBS found itself insolvent as the international credit market seized up. 58% of the shares were bought by the UK government. | |

| ABN-Amro | Oct 2008 | Banking | After a takeover battle between Barclays and RBS, which RBS won, ABN-Amro was found to be heavily indebted due to the sub-prime mortgage crisis. It was split and taken under government ownership by the UK and Netherlands. | |

| Nortel | 14 Jan 2009 | Telecomms | Following the 2007-2008 financial crisis, and allegations over excessive executive pay, demand for products dropped. | |

| Anglo Irish Bank | 15 Jan 2009 | Banking | After the financial crisis of 2007-2008, the bank was forced to be nationalised by the Irish government. | |

| Arcandor | 9 June 2009 | Retail | After struggling to maintain business levels at its brand names Karstadt and KaDeWe, Arcandor sought help from the German government, and then filed for insolvency. | |

| Schlecker | 23 Jan 2012 | Retail | After continual losses mounting from 2011 Schlecker, with 52,000 employees, was forced into insolvency, though continued to run. | |

| Dynegy | 6 July 2012 | Energy | After a series of attempted takeover bids, and a finding of fraud in a subsidiary’s purchase of another subsidiary, it filed for Chapter 11 bankruptcy. It emerged from bankruptcy on 2 October 2012. | |

| Banco Espírito Santo (BES) | 3 August 2014 | Banking | An audit performed in 2013, for a capital raise performed in May 2014, uncovered severe financial irregularities and a precarious financial situation the bank. The same year, its CEO, Ricardo Salgado, revealed 95 billion € of losses. In July 2014, Salgado was replaced by economist Vítor Bento, who saw BES in an irrecoverable situation. Its good assets were bought by Novo Banco, a vehicle founded by Portugal’s financial regulators for that purpose, on August 3, which hired Bento as CEO, while its toxic assets stayed in the “old” BES, which got its banking license revoked by Portugal’s regulators. |